|

"Oh this? No, it's just a hobby. I don't earn that much from it".

It's never been easier to work from home, create your craft, use an online sales platform and go forth to find your tribe. There's something about hustling around the kitchen table that makes it feel a long way from the big corporate world. The tricky bit tho' is whether what you're doing is really just a hobby or is it really a mini empire in the making? And unfortunately, the very same technology that allows you to thrive on your side-gig, is being used by the ATO to data match and find people not meeting their tax obligations. Whether it is in fact a hobby or a jobby is not yours at will to declare. Contrary to popular belief - it's also not determined by a dollar threshold. Really what you need to consider is whether you are approaching it in a business-like manner. If you are, chances are likely that you'll need to declare your income. Here's a few considerations that make your hobby more like a business:

Still not sure? Click here to go to the ATO website for further clarification.

1 Comment

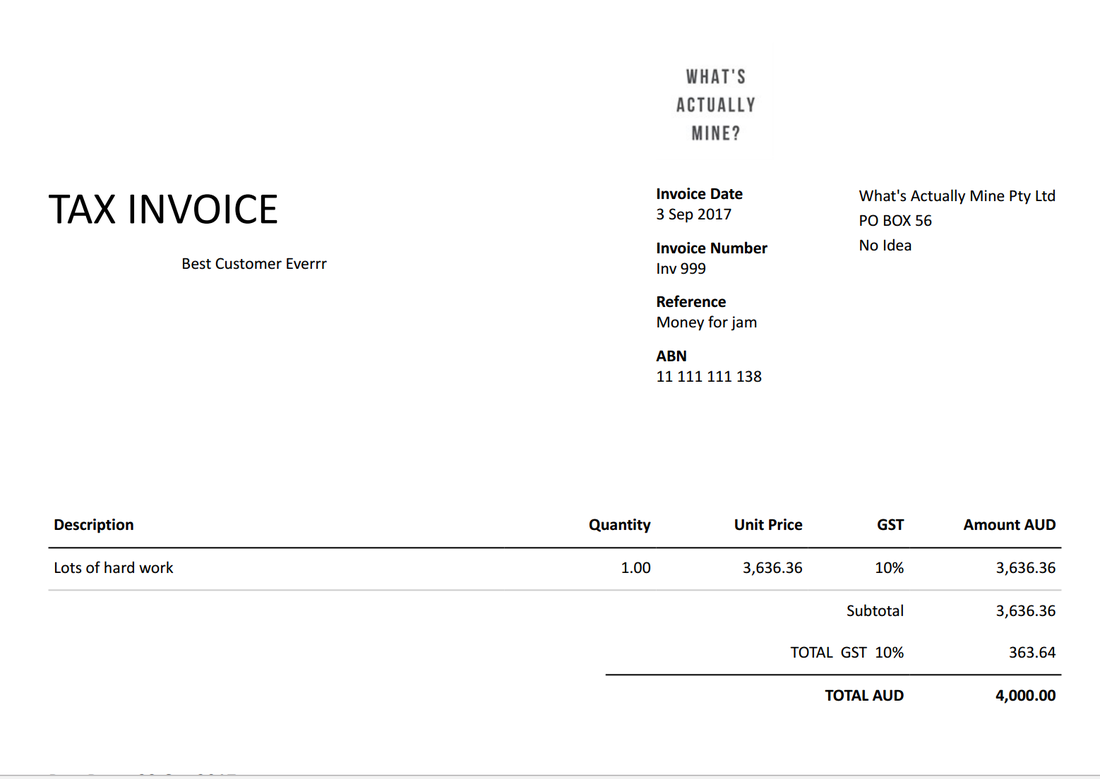

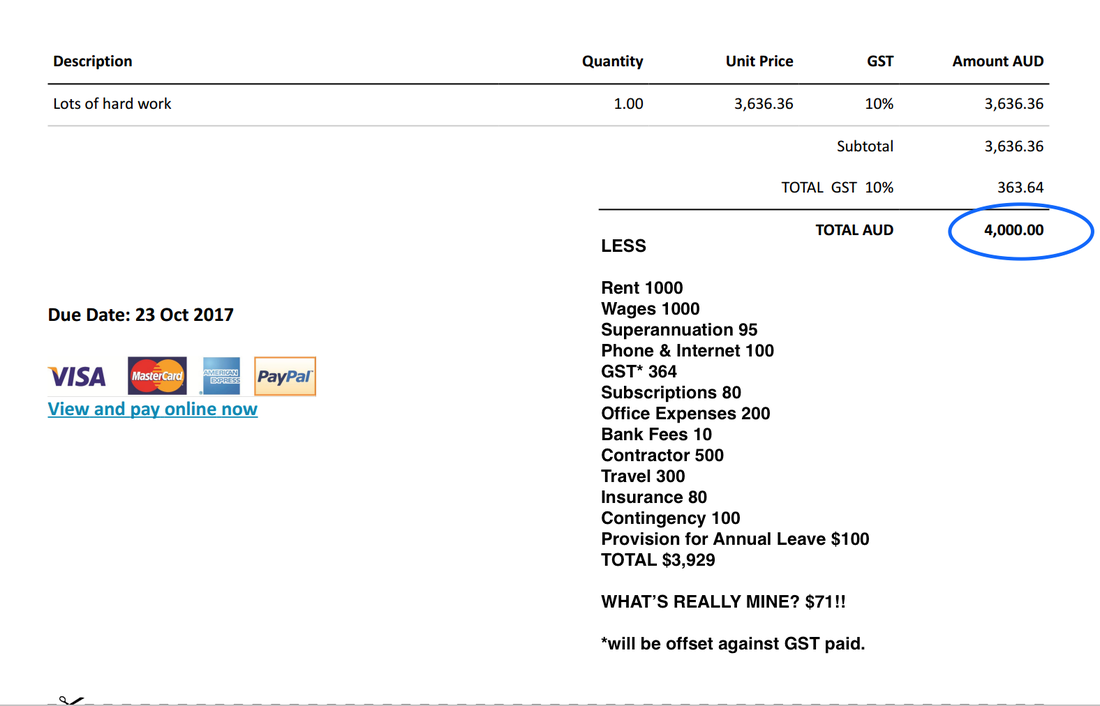

WOO HOO! The money has hit your bank account. Whether it's your very first invoice, or your largest one to date, or even just the one you've been sweating on - getting paid always feels sweet. It can also lead to a little whisper in your ear about how hard you've been working and how much you really, really deserve that [insert latest thing you covet]. And right here is where I see businesses get into trouble time and time again - spending dollars that aren't theirs in the first place! Simply knowing the current bank balance is not enough. You need to understand HOW MUCH of it is actually available for free spending. Whether you are a sole trader or operate a company, the same principle applies, understanding what's really yours (or the company's). Let's look at a really simple example where you're paid $4000 on the 3rd of a month. I stress simple - there are lots of apps that give you great insights into your cashflow position, but it's actually useful to understand this stuff at the base level without making it so complicated that you wont do it. Here's our invoice. Sweeeeeet, but lets take a look at what it needs to pay. Don't trip up on the lingo; overheads, COGS, expenses and liabilities owed, they all involve using up that incoming money. It also doesn't matter whether these exact examples apply to your business. It's the principle that matters. Focus on what you need to pay before it becomes money to spend freely.

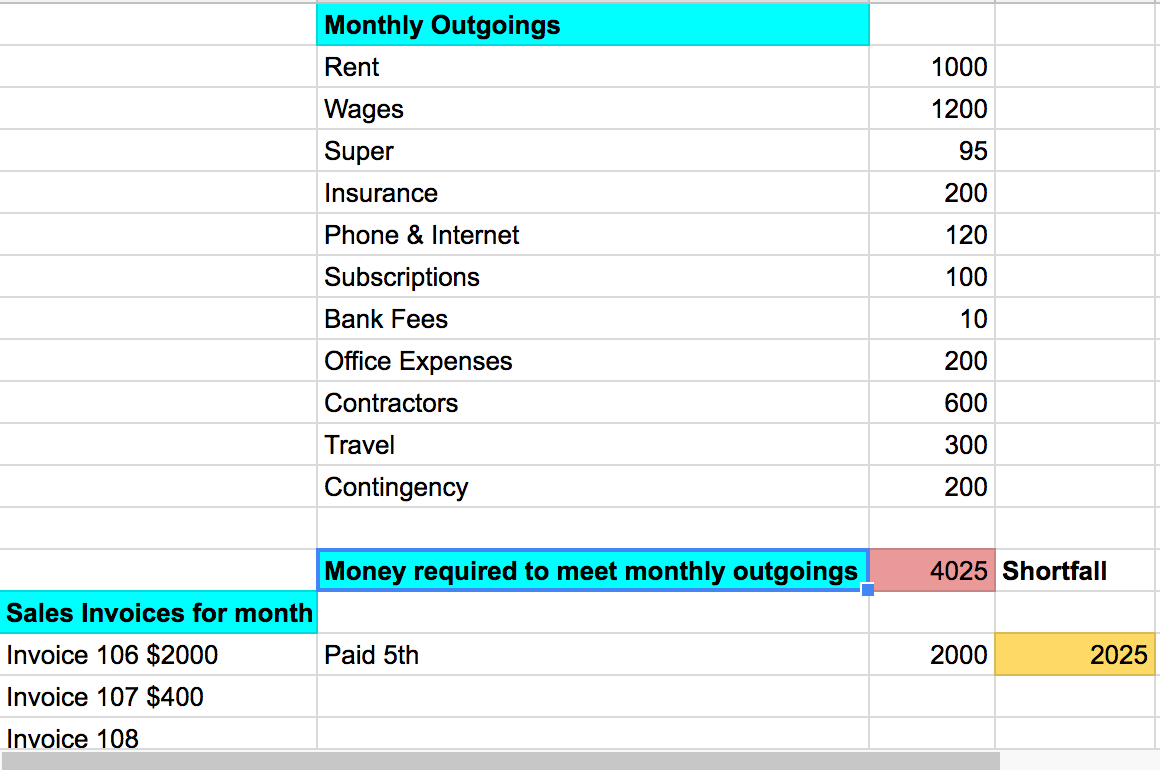

Suddenly, that $4k money shower is really only $71.00. Hashtag reality check! So if you've never done it before I urge you to use a simple spreadsheet like the one below. Map out your monthly expenses and track your progress as each invoice gets paid. It will literally take you 15 minutes to set up, 2 minutes each time you get paid and guarantee an extra 2 hours sleep per week! You'll see when you break even (cover costs) and when you have money available to spend as you wish. You can grab a FREE sample to adjust here - click here

|

AuthorGabrielle Osborne (BAcc) is a small business specialist who loves empowering creative minds by helping them make sense of their business numbers. Archives

December 2018

|